Projects listed: 276 |

BTC Dominance: 49.19% | Volume (24h): $37,585,537,004 | Market Cap: $2,481,017,280,109

Projects listed: 276 |

Sector

Exchange Debut

Market Cap

Maxim Supply

Circulating Supply

Circ. Supply(%)

Price

Market Cap

Sector

Exchange Debut

Volume 24h

High 24h

Low 24h

Change 24h

Change 7d

Change 30d

Maxim supply

Circulating supply

Circulating supply(%)

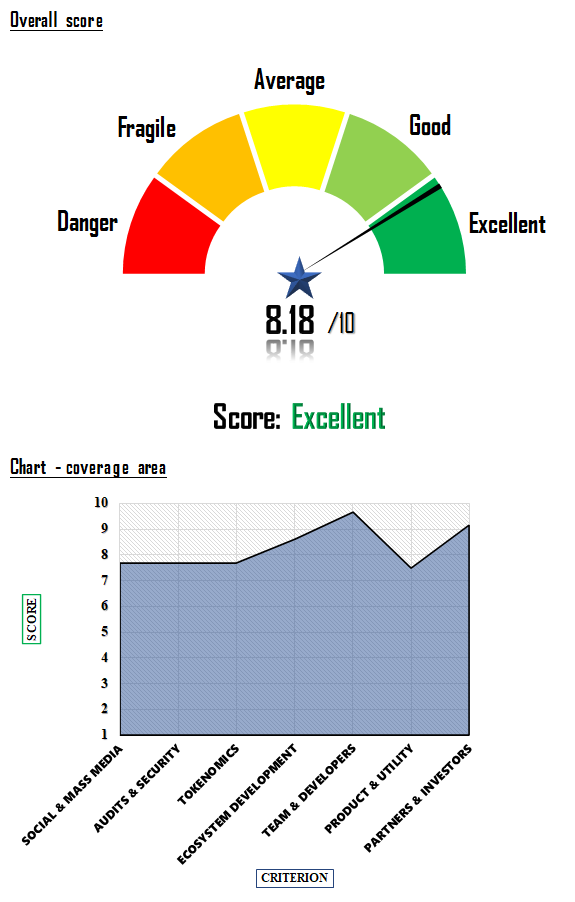

Polkadot is an impressive crypto project that is designed as a sharded multichain protocol to facilitate cross-chain transfer of any data or asset types, thereby fostering interoperability amongst different blockchains. By connecting public and private chains, permissionless networks, oracles, and future technologies, Polkadot aspires to lay the foundation for a user-controlled, decentralized web, also known as Web3. Based on a thorough „Fundamental analysis of the Polkadot cryptocurrency,” the project scores a commendable 8.18 out of 10, exhibiting strong potential in various key areas.

Polkadot has demonstrated a strong presence in the social and media spectrum, scoring a solid 7.7 out of 10. Their ability to attract followers and maintain a strong presence in the media, along with large communities on chat groups, signifies the broad appeal and visibility of the project. However, the activity of social media administrators and community activity on social pages could be improved to drive engagement and interaction.

On the „Audit & Security” front, Polkadot fares well with a score of 7.69 out of 10. It has maintained high liquidity on exchanges and the transparency of information available to the public is noteworthy. Although the audit results score could be improved, overall, Polkadot demonstrates a good measure of security and trustworthiness.

In the „Tokenomics” category, Polkadot scores 7.7 out of 10. While the project has a slight inflationary aspect, the decentralization of its monetary mass is commendable. The „Fundamental analysis of the Polkadot cryptocurrency” indicates that its token economics are well-designed, contributing to the overall health and sustainability of the Polkadot ecosystem.

The „Ecosystem Development” of Polkadot is robust, scoring 8.6 out of 10. The project demonstrates consistency in achieving its objectives and plans to bring new developments to the project. This indicates the dynamic nature and growth potential of Polkadot.

The team behind Polkadot, scoring 9.68 out of 10, is one of its strongest aspects. The experience of the team combined with a high number of software developers points to the exceptional technical competency of the project, fostering trust and confidence in the „Fundamental analysis of the Polkadot cryptocurrency.”

Polkadot’s product utility, with a score of 7.5 out of 10, suggests a balanced performance. The utility of tokens in the ecosystem is significant, though the overall utility of the product could be further enhanced to boost the project’s value proposition.

Polkadot’s partnerships and investors, scoring 9.15 out of 10, showcases the project’s strong market position. The number and capacity of investors are substantial, indicating confidence in the project’s future, and the quality of partners further validates the credibility and potential of Polkadot.

Final Conclusion

The overall score from the „fundamental analysis of the Polkadot cryptocurrency” suggests that Polkadot represents a promising investment opportunity. Its strong team, robust ecosystem development, substantial partnerships, and a decent social media presence are key strengths. However, the risk associated with its product utility and certain aspects of social media engagement should be considered. Despite these, Polkadot’s innovative approach towards creating a decentralized web and its commitment to bring new developments indicates a healthy growth trajectory.

Investors interested in projects with a strong foundation and a vision towards future technologies would find Polkadot appealing. It is important, however, to keep abreast of its ecosystem developments and tokenomics, as these factors could significantly impact its future value.

In essence, while every investment carries inherent risks, the „fundamental analysis of the Polkadot cryptocurrency” showcases that Polkadot holds potential for those willing to engage with a project that is at the forefront of blockchain interoperability and the development of Web3.

Nonetheless, potential investors should always do their own research, consider their risk tolerance and investment goals before investing in any cryptocurrency.

Polkadot (DOT) stands as an innovative open-source multichain protocol, building a decentralized internet of blockchains, coined as Web3. The protocol plays a crucial role in fostering the interconnection and security of specialized blockchains, enabling the seamless transfer of diverse data types or assets. Acting as a layer-0 metaprotocol, Polkadot offers a platform for a network of layer 1 blockchains, termed parachains. It further enhances its codebase autonomously, reflecting the community’s will through on-chain governance.

This pioneering technology promotes a user-centric decentralized web, streamlining the creation of fresh applications, services, and institutions. It has the power to bridge public and private chains, permissionless networks, oracles, and prospective technologies, fostering trustless information sharing and transactions via the Polkadot Relay Chain. The DOT token serves three fundamental roles: securing the network through staking, enabling network governance, and bonding tokens to connect parachains.

Polkadot’s anatomy comprises four central components: the Relay Chain forms the heart of the system, ensuring consensus, interoperability, and shared security across chains; Parachains operate as independent chains with their own tokens and specific use-cases; Parathreads bear resemblance to parachains but provide flexible connectivity; Bridges facilitate communication between parachains and external blockchains such as Ethereum.

Polkadot is the brainchild of Dr. Gavin Wood, Robert Habermeier, and Peter Czaban, operating under the banner of Web3 Foundation, committed to developing a user-friendly decentralized web. Dr. Wood, a noteworthy figure in the industry, is known for his significant contributions as Ethereum’s co-founder and creator of the smart contract coding language, Solidity.

Polkadot’s uniqueness lies in its sharded multichain network capability, which bolsters scalability by facilitating parallel transaction processing across chains. With the help of the Substrate framework, custom blockchains can be developed and easily integrated into the Polkadot network. Polkadot boasts of a robust user-driven governance system, offering customization based on individual blockchain needs.

In 2021, Polkadot successfully hosted its first Parachain auctions, with the top bids secured by Acala, Moonbeam, Astar, Parallel, and Clover. With this, they’ve earned their parachain slots for 96 weeks, backed by the DOT tokens pledged as collateral. This development emphasizes Polkadot’s commitment to fostering a reliable and secure decentralized web.

In conclusion, the „Fundamental Analysis of Polkadot Cryptocurrency” reveals its significant role in the blockchain ecosystem, facilitating interoperability and scalability while ensuring user-centric decentralized web development.

Social & Mass Media In this section was taken into consideration the intensity of the activity of the social media page of the administrators , the speed of the community growth, the user interaction with the pages and as well the number of media appearances in the most important trade publications.

Audit & Security In particular, the team looks if the project is audited, how extensive the audit is, at the bug bounty program, if it had incidents or not, at the liquidity on the exchanges and at the transparency of the information provided.

Tokenomics Under this criterion it is analyzed whether the project is inflationary or not, whether it has maximum supply, the percentage of supply released into the market at the time of the analysis, the rate of inflation per year, the distribution of supply in the portfolios as well as the vesting plan.

Ecosistem Development In this section is checked if the project has delivered on time what it proposed in the roadmap, the degree of participation in the project governance of the community, the activity and intensity of the developments published on github and what products or applications the team proposes to develop in the future.

Team & Developers It checks if the team is public, the quality of the team behind the project, the number of members on different domains, the experience in IT, finance and cryptography, the traceability of published information about team members and as well the number of developers in the project.

Product & Utility It checks if there are functional products, the number of users and the revenues generated by these products, the sustainability of the project and the usefulness offered in the cryptographic space and as well as in other fields of activity.

Partners & Investors It analyzes the partners and the degree of their involvement in the project, the capacity of investors and investment funds that can contribute substantially to the development of the ecosystem.

Social & Mass Media In this section was taken into consideration the intensity of the activity of the social media page of the administrators , the speed of the community growth, the user interaction with the pages and as well the number of media appearances in the most important trade publications.

Audit & Security In particular, the team looks if the project is audited, how extensive the audit is, at the bug bounty program, if it had incidents or not, at the liquidity on the exchanges and at the transparency of the information provided.

Tokenomics Under this criterion it is analyzed whether the project is inflationary or not, whether it has maximum supply, the percentage of supply released into the market at the time of the analysis, the rate of inflation per year, the distribution of supply in the portfolios as well as the vesting plan.

Ecosistem Development In this section is checked if the project has delivered on time what it proposed in the roadmap, the degree of participation in the project governance of the community, the activity and intensity of the developments published on github and what products or applications the team proposes to develop in the future.

Team & Developers It checks if the team is public, the quality of the team behind the project, the number of members on different domains, the experience in IT, finance and cryptography, the traceability of published information about team members and as well the number of developers in the project.

Product & Utility It checks if there are functional products, the number of users and the revenues generated by these products, the sustainability of the project and the usefulness offered in the cryptographic space and as well as in other fields of activity.

Partners & Investors It analyzes the partners and the degree of their involvement in the project, the capacity of investors and investment funds that can contribute substantially to the development of the ecosystem.

This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish.

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| _ga | coin-score.ai | Google Universal Analytics long-time unique user tracking identifier. | 2 years | HTTP |

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| _ga_QJD5B840TY | coin-score.ai | --- | 2 years | --- |