Projects listed: 276 |

BTC Dominance: 0.00% | Volume (24h): $36,478,684,994 | Market Cap: $2,568,812,883,097

Projects listed: 276 |

Sector

Exchange Debut

Market Cap

Maxim Supply

Circulating Supply

Circ. Supply(%)

Price

Market Cap

Sector

Exchange Debut

Volume 24h

High 24h

Low 24h

Change 24h

Change 7d

Change 30d

Maxim supply

Circulating supply

Circulating supply(%)

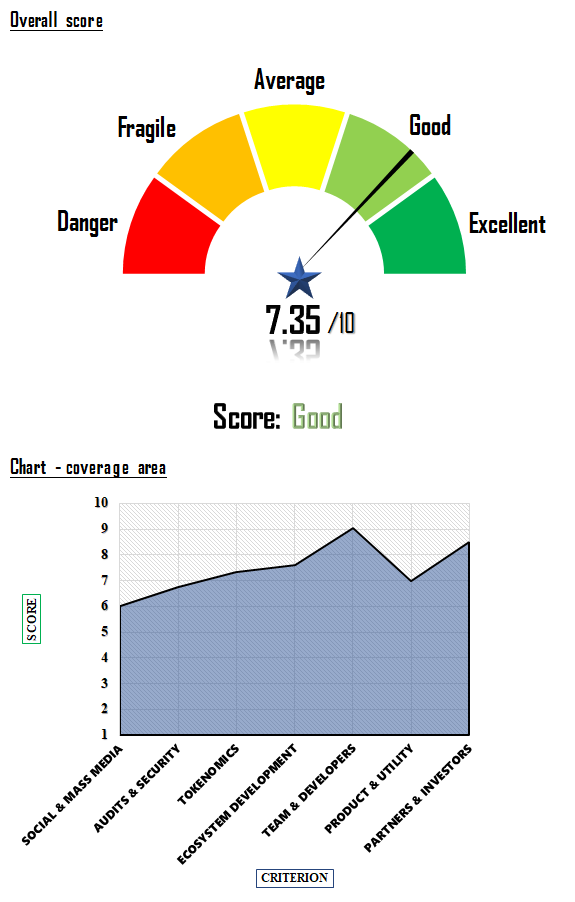

Kadena KDA, a hybrid proof-of-work blockchain system, harmoniously intertwines Bitcoin’s robust security features with the scalability of directed acyclic graph (DAG) principles. The project’s unique proposition offers industrial scalability akin to global financial infrastructures, presenting itself as an energy-efficient alternative to its contemporaries. Notably, Kadena’s multi-chain approach and its private Kuro layer-two blockchain emphasize its commitment to mass adoption and high transactional volume. In a thorough fundamental analysis of the Kadena KDA cryptocurrency, the project earned a notable score of 7.35 out of 10.

Despite a strong presence and an ability to attract followers on its social media pages, Kadena faces challenges in media visibility and overall community activity. This emphasizes the need for more aggressive outreach and public relations strategies. Nevertheless, the sizeable community in chat groups does suggest a core group of enthusiasts who could be instrumental in future growth.

Kadena’s audit results might be concerning for some, but its high liquidity on exchanges and commendable transparency showcase the project’s trustworthiness. It’s evident from the fundamental analysis of the Kadena KDA cryptocurrency that improvements can be made in the realm of security audits to further establish investor confidence.

The token economy appears fairly robust, with a slight concern towards inflation and monetary centralization. However, it’s worth noting that the core structure seems designed for stability and potential long-term growth.

While Kadena has met several of its objectives, the fundamental analysis of the Kadena KDA cryptocurrency hints at the desire for continuous innovation. Future developments and regular updates can ensure that the project remains relevant in the ever-evolving crypto landscape.

The project’s backbone lies in its highly experienced team, although the number of software developers could be increased to expedite growth and address any technical challenges promptly.

Both the product’s utility and the role of tokens in the ecosystem show promise, but continuous innovation and usability improvements will further solidify Kadena’s standing.

Impressively, Kadena boasts strong investors and partnerships, an essential foundation for any project aiming for longevity and widespread adoption.

The fundamental analysis of the Kadena KDA cryptocurrency paints a picture of a project with immense potential but certain areas that warrant enhancement. Given its technical ingenuity, adept team, and solid partnerships, Kadena stands as a noteworthy investment opportunity in the crypto domain. Nonetheless, potential investors should weigh the risks associated with its moderate scores in media presence and security audits. In the crypto space, where volatility and dynamism are the norms, Kadena’s core strengths might serve as its guiding beacon, but continuous adaptation is the key.

Kadena, a hybrid proof-of-work blockchain, blends Bitcoin’s PoW consensus and directed acyclic graph (DAG) principles, aiming to revolutionize scalability and security in the crypto realm. Built on an innovative multi-chain approach, it boasts a potential to provide unparalleled transaction throughput, enticing both entrepreneurs and large enterprises. What sets Kadena apart is its promise of vast industrial scalability, mirroring global financial systems, while maintaining energy efficiency. This adaptability is evident as Kadena successfully expanded from 10 to 20 blockchains, and with its Kuro layer-two blockchain, it can manage a whopping 8,000 transactions per second.

The brains behind Kadena, Stuart Popejoy and Will Martino, previously shaped the blockchain vision at JPMorgan. Their expertise, combined with Dr. Stuart Haber’s, the co-inventor of blockchain technology, makes Kadena’s foundation formidable.

Harnessing the power of multiple parallel blockchains, Kadena can mint several blocks at once, increasing both throughput and security. Its unique DAG structure is fixed and multi-channel, ensuring efficient real-world performance. Kadena’s scalability potential is immense, yet it hinges on adoption; hard forks are essential to add more blockchains. An integral part of its defense mechanism, Chainweb, interlinks its PoW blockchains, ensuring consistent transaction history views across chains. This fortified setup means attackers must compromise all chains to breach one. Moreover, Kadena’s Pact, a human-readable smart contract language, boasts robust security features.

By integrating this synthesis of advanced technologies and strategic foundations, the fundamental analysis of Kadena paints a promising future for the KDA cryptocurrency in the digital finance domain.

Social & Mass Media In this section was taken into consideration the intensity of the activity of the social media page of the administrators , the speed of the community growth, the user interaction with the pages and as well the number of media appearances in the most important trade publications.

Audit & Security In particular, the team looks if the project is audited, how extensive the audit is, at the bug bounty program, if it had incidents or not, at the liquidity on the exchanges and at the transparency of the information provided.

Tokenomics Under this criterion it is analyzed whether the project is inflationary or not, whether it has maximum supply, the percentage of supply released into the market at the time of the analysis, the rate of inflation per year, the distribution of supply in the portfolios as well as the vesting plan.

Ecosistem Development In this section is checked if the project has delivered on time what it proposed in the roadmap, the degree of participation in the project governance of the community, the activity and intensity of the developments published on github and what products or applications the team proposes to develop in the future.

Team & Developers It checks if the team is public, the quality of the team behind the project, the number of members on different domains, the experience in IT, finance and cryptography, the traceability of published information about team members and as well the number of developers in the project.

Product & Utility It checks if there are functional products, the number of users and the revenues generated by these products, the sustainability of the project and the usefulness offered in the cryptographic space and as well as in other fields of activity.

Partners & Investors It analyzes the partners and the degree of their involvement in the project, the capacity of investors and investment funds that can contribute substantially to the development of the ecosystem.

Social & Mass Media In this section was taken into consideration the intensity of the activity of the social media page of the administrators , the speed of the community growth, the user interaction with the pages and as well the number of media appearances in the most important trade publications.

Audit & Security In particular, the team looks if the project is audited, how extensive the audit is, at the bug bounty program, if it had incidents or not, at the liquidity on the exchanges and at the transparency of the information provided.

Tokenomics Under this criterion it is analyzed whether the project is inflationary or not, whether it has maximum supply, the percentage of supply released into the market at the time of the analysis, the rate of inflation per year, the distribution of supply in the portfolios as well as the vesting plan.

Ecosistem Development In this section is checked if the project has delivered on time what it proposed in the roadmap, the degree of participation in the project governance of the community, the activity and intensity of the developments published on github and what products or applications the team proposes to develop in the future.

Team & Developers It checks if the team is public, the quality of the team behind the project, the number of members on different domains, the experience in IT, finance and cryptography, the traceability of published information about team members and as well the number of developers in the project.

Product & Utility It checks if there are functional products, the number of users and the revenues generated by these products, the sustainability of the project and the usefulness offered in the cryptographic space and as well as in other fields of activity.

Partners & Investors It analyzes the partners and the degree of their involvement in the project, the capacity of investors and investment funds that can contribute substantially to the development of the ecosystem.

This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish.

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| _ga | coin-score.ai | Google Universal Analytics long-time unique user tracking identifier. | 2 years | HTTP |

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| _ga_QJD5B840TY | coin-score.ai | --- | 2 years | --- |