Projects listed: 276 |

BTC Dominance: 0.00% | Volume (24h): $42,813,574,301 | Market Cap: $2,606,848,781,930

Projects listed: 276 |

Sector

Exchange Debut

Market Cap

Maxim Supply

Circulating Supply

Circ. Supply(%)

Price

Market Cap

Sector

Exchange Debut

Volume 24h

High 24h

Low 24h

Change 24h

Change 7d

Change 30d

Maxim supply

Circulating supply

Circulating supply(%)

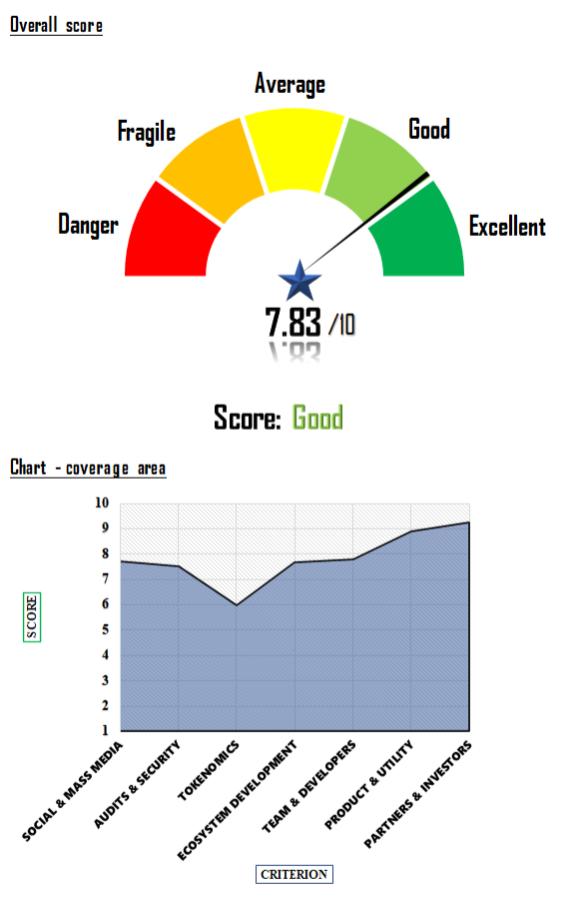

Fundamental analysis of the STEPN cryptocurrency reveals an intriguing project merging the spheres of fitness, blockchain, and GameFi. From an overall perspective, STEPN scores a commendable 7.83 out of 10, showing potential and room for improvement.

Score 7.7 out of 10 In the realm of social and media presence, STEPN shines with a score of 7.7 out of 10. The project exhibits outstanding ability to attract followers on social media with a perfect score of 10, and strong media presence with a 9. However, the relatively low community activity on social media (1 out of 10) is a point of concern. A stronger community engagement strategy could improve this facet of the „Fundamental analysis of the STEPN cryptocurrency”.

Score 7.54 out of 10 STEPN fares well in the audit and security front, scoring 7.54 out of 10. The results of the audits are satisfactory, though there’s room for improvement. Transparency and liquidity are remarkably high, which supports the reliability of the project.

Score 6 out of 10 With a score of 6 out of 10, the token economy of STEPN suggests potential concerns. The project is mildly inflationary and the monetary mass is somewhat centralized, warranting a close watch for those invested in STEPN. „Fundamental analysis of the STEPN cryptocurrency” recommends further exploration of tokenomics to mitigate risks and promote balanced growth.

Score 7.68 out of 10 STEPN performs well in ecosystem development, scoring 7.68 out of 10. The team consistently achieves objectives and plans for new developments, suggesting a promising future trajectory.

TEAM & DEVELOPERS:

Score 7.8 out of 10 The STEPN team and developers, with a score of 7.8 out of 10, display proficiency and dedication. While the experience of the team is high (8.5), a score of 5 for the number of software developers indicates the need for scaling up the development team.

Score 8.9 out of 10 STEPN’s product utility scores an impressive 8.9 out of 10. The unique fusion of fitness and blockchain tech provides high utility, with tokens playing a significant role in the ecosystem. The score aligns with the „Fundamental analysis of the STEPN cryptocurrency”.

Score 9.25 out of 10 Finally, STEPN’s partnerships and investors aspect garners an impressive 9.25 out of 10. This high score reflects an excellent number and capacity of investors, as well as quality partners, reinforcing the credibility and potential of the project.

Overall, the „Fundamental analysis of the cryptocurrency STEPN” suggests a promising project with a few areas of improvement. It’s an innovative venture, merging fitness and blockchain tech, making it a potential pioneer in the „move-to-earn” category. However, the potential risks associated with the token economy should be closely monitored, as should the social media community engagement. As an investment, STEPN shows potential, but as with any investment, a well-rounded approach considering risk and reward is necessary.

Investors considering STEPN should also pay close attention to its ecosystem development, given its current high score of 7.68. The consistent achievement of objectives and the team’s plans for new developments signals growth and a potential increase in the value of the cryptocurrency. With the unique nature of the STEPN project, its unique fusion of the fitness world with the emerging GameFi space, and the high utility of its tokens, we could see a new trend-setter in the crypto market. That being said, it is crucial to remember that while the „Fundamental analysis of the STEPN cryptocurrency” reflects an overall positive outlook, investment decisions should also consider the dynamic and often volatile nature of cryptocurrency markets.

In August 2021, the blockchain sector witnessed the inception of STEPN, an innovative fitness venture by Australian blockchain tycoon Yawn Rong, alongside his associate Jerry Huang. Their collective past experience spans from running Crypto SA and Falafel Games to advocating for Algorand and South Australian Blockchain Association. Their novel project garnered a substantial $5 million seed funding from prominent crypto venture capital groups such as Sequoia Capital and Alameda Research, also attracting angel investors like Santiago R Santos and Zhen Cao.

STEPN is uniquely poised to revolutionize the fitness industry by offering token-based incentives to its users. Users engage with the app by purchasing NFT sneakers, thereby unlocking the potential to earn Green Satoshi Tokens (GST) through physical activities. The concept is rooted in gamifying fitness, encouraging healthier lifestyles by rewarding daily activities, and creating competitive events like marathons.

Moreover, STEPN enhances its appeal by directly contributing to the global climate change conversation. Users aren’t only incentivized to live healthier but also to participate in carbon neutrality efforts. As part of its commitment, STEPN purchases Carbon Removal Credits on Solana, contributing significantly to the fight against climate change.

The inception of STEPN marks a new chapter in the fusion of fitness and cryptocurrency sectors. The innovative application combines the financial and emotional benefits of healthy living with token rewards. This new phase is set to cause significant disruption and transformation in both fitness and cryptocurrency industries, making STEPN an interesting topic for fundamental analysis in the cryptocurrency world.

Social & Mass Media In this section was taken into consideration the intensity of the activity of the social media page of the administrators , the speed of the community growth, the user interaction with the pages and as well the number of media appearances in the most important trade publications.

Audit & Security In particular, the team looks if the project is audited, how extensive the audit is, at the bug bounty program, if it had incidents or not, at the liquidity on the exchanges and at the transparency of the information provided.

Tokenomics Under this criterion it is analyzed whether the project is inflationary or not, whether it has maximum supply, the percentage of supply released into the market at the time of the analysis, the rate of inflation per year, the distribution of supply in the portfolios as well as the vesting plan.

Ecosistem Development In this section is checked if the project has delivered on time what it proposed in the roadmap, the degree of participation in the project governance of the community, the activity and intensity of the developments published on github and what products or applications the team proposes to develop in the future.

Team & Developers It checks if the team is public, the quality of the team behind the project, the number of members on different domains, the experience in IT, finance and cryptography, the traceability of published information about team members and as well the number of developers in the project.

Product & Utility It checks if there are functional products, the number of users and the revenues generated by these products, the sustainability of the project and the usefulness offered in the cryptographic space and as well as in other fields of activity.

Partners & Investors It analyzes the partners and the degree of their involvement in the project, the capacity of investors and investment funds that can contribute substantially to the development of the ecosystem.

Social & Mass Media In this section was taken into consideration the intensity of the activity of the social media page of the administrators , the speed of the community growth, the user interaction with the pages and as well the number of media appearances in the most important trade publications.

Audit & Security In particular, the team looks if the project is audited, how extensive the audit is, at the bug bounty program, if it had incidents or not, at the liquidity on the exchanges and at the transparency of the information provided.

Tokenomics Under this criterion it is analyzed whether the project is inflationary or not, whether it has maximum supply, the percentage of supply released into the market at the time of the analysis, the rate of inflation per year, the distribution of supply in the portfolios as well as the vesting plan.

Ecosistem Development In this section is checked if the project has delivered on time what it proposed in the roadmap, the degree of participation in the project governance of the community, the activity and intensity of the developments published on github and what products or applications the team proposes to develop in the future.

Team & Developers It checks if the team is public, the quality of the team behind the project, the number of members on different domains, the experience in IT, finance and cryptography, the traceability of published information about team members and as well the number of developers in the project.

Product & Utility It checks if there are functional products, the number of users and the revenues generated by these products, the sustainability of the project and the usefulness offered in the cryptographic space and as well as in other fields of activity.

Partners & Investors It analyzes the partners and the degree of their involvement in the project, the capacity of investors and investment funds that can contribute substantially to the development of the ecosystem.

This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish.

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| _ga | coin-score.ai | Google Universal Analytics long-time unique user tracking identifier. | 2 years | HTTP |

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| _ga_QJD5B840TY | coin-score.ai | --- | 2 years | --- |