Projects listed: 276 |

BTC Dominance: 0.00% | Volume (24h): $42,850,283,271 | Market Cap: $2,608,195,360,006

Projects listed: 276 |

Sector

Exchange Debut

Market Cap

Maxim Supply

Circulating Supply

Circ. Supply(%)

Price

Market Cap

Sector

Exchange Debut

Volume 24h

High 24h

Low 24h

Change 24h

Change 7d

Change 30d

Maxim supply

Circulating supply

Circulating supply(%)

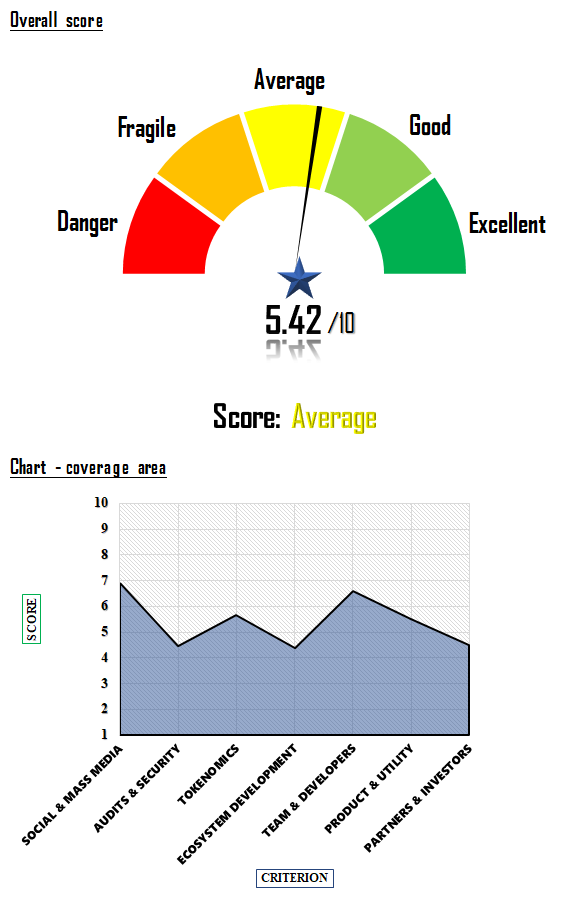

Access Protocol-ACS represents an innovative approach to digital content monetization, offering a model where users lock ACS tokens to access creators’ content, potentially transforming the traditional subscription-based models. This system not only simplifies transactions for users but also provides creators with a more consistent and equitable compensation method, based on the proportion of locked tokens in their pool. Despite its novel approach, the overall score of 5.42 out of 10 from the fundamental analysis of the Access Protocol-ACS cryptocurrency indicates areas needing improvement alongside its strengths.

The Access Protocol-ACS excels in social media engagement, evident from perfect scores in attracting followers and community activity. However, its media presence is notably weaker. The active and engaged social media presence indicates a strong community foundation, crucial for long-term success in the crypto world.

Audit and security aspects are fundamental in the cryptocurrency space. Access Protocol-ACS scores moderately here, highlighting a need for enhanced transparency and improved audit results. Strengthening these areas is essential to foster trust and security among users and investors.

The token economy of Access Protocol-ACS presents a balanced approach with moderate centralization. However, its inflationary aspects require attention to ensure long-term sustainability and value retention of the ACS tokens.

In terms of ecosystem development, Access Protocol-ACS shows potential but also indicates a need for more robust achievement of objectives and further development plans. Continual evolution and adaptation are key to thriving in the dynamic crypto market.

The project boasts a team with substantial experience, though the relatively small number of software developers is a concern. Expanding the development team could accelerate innovation and implementation of the Access Protocol-ACS.

The utility of the Access Protocol-ACS product and tokens within the ecosystem scores above average. Enhancing the utility of tokens could further solidify its market position and user appeal.

The quality of partners is notable, but the limited number and capacity of investors suggest room for growth in this area. Attracting more robust investment could provide valuable resources for expansion and development.

Considering the scores and aspects of the fundamental analysis of the Access Protocol-ACS cryptocurrency, it’s clear that while the project has substantial promise, particularly in its innovative approach to content monetization and strong social media presence, there are areas requiring attention. The moderate scores in audit, security, and ecosystem development, coupled with the need for a larger development team and increased investor engagement, highlight critical areas for improvement. For investors, while there are evident risks due to these shortcomings, the unique value proposition of Access Protocol-ACS presents a notable opportunity, especially if the team can address these concerns effectively. As with any investment in the volatile cryptocurrency market, potential investors should weigh these factors carefully.

Access Protocol introduces a novel approach to digital content monetization through the use of its ACS tokens. Unlike traditional models, this system allows users to lock ACS tokens into a creator’s pool. This eliminates recurring credit card charges, offering a one-time token lock for continuous access to content. This fungible ACS token streamlines the user experience across various creators, avoiding the complexity of multiple credit card payments.

This protocol presents a transformative model for all digital content creators, from media companies to individual influencers. By joining the Access ecosystem, new creators can leverage an existing network of tools, users, and value. The protocol’s reward mechanism incentivizes creators to produce valuable content, aligning their interests with those of the consumers rather than sponsors. In essence, it fosters a mutually beneficial relationship between content producers and their audience.

The protocol encourages the growth of fee-generating users, aiming to surpass the typical audience penetration rates of major digital media companies. Its seamless integration with third-party wallets for ACS token locking simplifies content access, offering a frictionless alternative to traditional credit card-based subscriptions. This potentially leads to increased audience sizes and long-term, fee-generating users.

Access Protocol significantly increases the Lifetime Value (LTV) of users for creators. By allowing creators to set a minimum threshold for ACS tokens in their pool without a maximum limit, the protocol opens doors for ‘super supporters’. These supporters can lock a higher number of tokens, indicating their enhanced commitment and contributing to a higher Average Revenue Per User (ARPU) and LTV. The protocol also offers unique opportunities for creators to acknowledge and reward their super supporters, further strengthening the creator-consumer relationship.

Social & Mass Media In this section was taken into consideration the intensity of the activity of the social media page of the administrators , the speed of the community growth, the user interaction with the pages and as well the number of media appearances in the most important trade publications.

Audit & Security In particular, the team looks if the project is audited, how extensive the audit is, at the bug bounty program, if it had incidents or not, at the liquidity on the exchanges and at the transparency of the information provided.

Tokenomics Under this criterion it is analyzed whether the project is inflationary or not, whether it has maximum supply, the percentage of supply released into the market at the time of the analysis, the rate of inflation per year, the distribution of supply in the portfolios as well as the vesting plan.

Ecosistem Development In this section is checked if the project has delivered on time what it proposed in the roadmap, the degree of participation in the project governance of the community, the activity and intensity of the developments published on github and what products or applications the team proposes to develop in the future.

Team & Developers It checks if the team is public, the quality of the team behind the project, the number of members on different domains, the experience in IT, finance and cryptography, the traceability of published information about team members and as well the number of developers in the project.

Product & Utility It checks if there are functional products, the number of users and the revenues generated by these products, the sustainability of the project and the usefulness offered in the cryptographic space and as well as in other fields of activity.

Partners & Investors It analyzes the partners and the degree of their involvement in the project, the capacity of investors and investment funds that can contribute substantially to the development of the ecosystem.

Social & Mass Media In this section was taken into consideration the intensity of the activity of the social media page of the administrators , the speed of the community growth, the user interaction with the pages and as well the number of media appearances in the most important trade publications.

Audit & Security In particular, the team looks if the project is audited, how extensive the audit is, at the bug bounty program, if it had incidents or not, at the liquidity on the exchanges and at the transparency of the information provided.

Tokenomics Under this criterion it is analyzed whether the project is inflationary or not, whether it has maximum supply, the percentage of supply released into the market at the time of the analysis, the rate of inflation per year, the distribution of supply in the portfolios as well as the vesting plan.

Ecosistem Development In this section is checked if the project has delivered on time what it proposed in the roadmap, the degree of participation in the project governance of the community, the activity and intensity of the developments published on github and what products or applications the team proposes to develop in the future.

Team & Developers It checks if the team is public, the quality of the team behind the project, the number of members on different domains, the experience in IT, finance and cryptography, the traceability of published information about team members and as well the number of developers in the project.

Product & Utility It checks if there are functional products, the number of users and the revenues generated by these products, the sustainability of the project and the usefulness offered in the cryptographic space and as well as in other fields of activity.

Partners & Investors It analyzes the partners and the degree of their involvement in the project, the capacity of investors and investment funds that can contribute substantially to the development of the ecosystem.

This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish.

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| _ga | coin-score.ai | Google Universal Analytics long-time unique user tracking identifier. | 2 years | HTTP |

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| _ga_QJD5B840TY | coin-score.ai | --- | 2 years | --- |