Projects listed: 276 |

BTC Dominance: 0.00% | Volume (24h): $36,579,311,584 | Market Cap: $2,574,616,680,830

Projects listed: 276 |

Sector

Exchange Debut

Market Cap

Maxim Supply

Circulating Supply

Circ. Supply(%)

Price

Market Cap

Sector

Exchange Debut

Volume 24h

High 24h

Low 24h

Change 24h

Change 7d

Change 30d

Maxim supply

Circulating supply

Circulating supply(%)

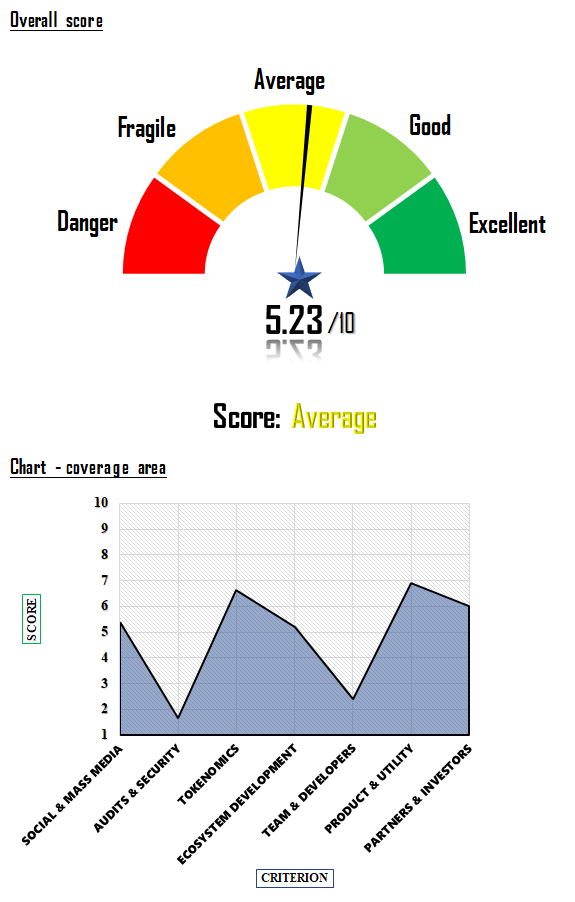

ALEX Lab, standing at the forefront of DeFi innovation on Bitcoin via Stacks, embodies a significant stride in decentralized finance with its focus on Bitcoin-based lending, borrowing, and advanced financial functions through Automated Liquidity Exchange algorithms. However, the fundamental analysis of the ALEX Lab cryptocurrency reveals a blend of strengths and weaknesses, culminating in an overall score of 5.23 out of 10, suggesting areas of potential growth alongside existing challenges.

ALEX Lab exhibits a mixed performance in social and mass media. The project excels in attracting followers on social media, scoring a perfect 10, showcasing its strong appeal and outreach. However, the activities of social media administrators and community engagement are moderate, each scoring 6. The relatively low scores in media presence and community sizes on chat groups, both at 4, indicate areas needing enhancement. These aspects are crucial for sustained growth and engagement in the rapidly evolving crypto space.

The audit and security aspect of ALEX Lab raises significant concerns. The absence of audit results, marked by a score of 0, is alarming, considering the importance of security in DeFi projects. The moderate transparency score of 7 and liquidity score of 4 suggest some level of reliability but do not offset the critical lack of audits. This area requires urgent attention to build trust and ensure the security of users’ investments.

The token economy of ALEX Lab presents a balanced approach, with its management of inflation and decentralization scoring well. However, further efforts in reducing centralization could bolster the project’s economic stability, an aspect underscored in the fundamental analysis of the ALEX Lab cryptocurrency.

The ecosystem development of ALEX Lab is progressing steadily, with an overall score of 5.20. Achieving objectives and planning new developments both score 6, indicating a forward-moving trajectory. Continued focus on these areas is essential for the project’s long-term success and to keep up with the dynamic nature of DeFi.

The team behind ALEX Lab faces notable challenges, reflected in their low score of 2.40. The team’s experience and the number of software developers, scoring 2 and 4 respectively, suggest a need for stronger expertise and more resources. Enhancing the team’s capabilities is crucial for the project’s development and execution.

ALEX Lab’s product and utility score of 6.90 is promising. The product’s utility scores a commendable 7.50, indicating its relevance and usefulness in the DeFi space. The utility of tokens within the ecosystem, scoring 6, also shows good integration and application. This balance is key in maintaining user interest and project viability.

In the domain of partners and investors, ALEX Lab has established a solid base, though there is scope for improvement in forming stronger partnerships. This factor plays a significant role in the project’s stability and growth prospects, as identified in the fundamental analysis of the ALEX Lab cryptocurrency.

In conclusion, ALEX Lab’s journey in the DeFi realm, as evidenced by the fundamental analysis of the ALEX Lab cryptocurrency, presents a blend of innovation and areas for improvement. The project’s strengths in tokenomics, product utility, and social media presence are offset by critical gaps in team experience, audit and security measures. With a total score of 5.23, ALEX Lab stands at a crossroads. The project holds potential but also bears significant risks, especially in security and team development. For investors, this translates to a cautious approach, balancing the innovative aspects of ALEX Lab against the need for enhanced security and team expertise. The fundamental analysis underscores the importance of holistic development in cryptocurrency projects for sustained success and investor confidence.

ALEX Lab introduces a revolutionary platform in the DeFi sector, utilizing Bitcoin via the Stacks network. This unique approach significantly changes the DeFi scene. By enabling simple financial processes like lending and borrowing Bitcoin, it sets the stage for more intricate financial operations.

At the heart of ALEX Lab’s operation are its smart contracts. These are essential in handling Bitcoin loans and are equally vital for creating decentralized bonds. Consequently, these bonds allow ALEX Lab to mirror various derivative products. This feature is key to expanding the platform’s financial functions.

The Automated Liquidity Exchange, or ALEX, is central to the platform’s functionality. It replaces traditional financial methods with advanced algorithms, indicating a shift in financial practices. These algorithms adeptly manage complex tasks like leverage, thus extending the range of DeFi services.

ALEX Lab prioritizes making its services user-friendly, even for those new to DeFi. The platform simplifies complex financial terms, making DeFi more accessible. This approach does not lessen the platform’s effectiveness but rather makes it more appealing to a diverse user base.

Looking forward, ALEX Lab is poised to be a significant contributor to the DeFi industry. Its focus on leveraging Bitcoin through Stacks opens up new possibilities in financial transactions. The fundamental analysis of the ALEX Lab cryptocurrency indicates a growing platform, distinguished by its novel approach to decentralized finance. As the DeFi world evolves, ALEX Lab’s influence in molding its future is increasingly evident.

Social & Mass Media In this section was taken into consideration the intensity of the activity of the social media page of the administrators , the speed of the community growth, the user interaction with the pages and as well the number of media appearances in the most important trade publications.

Audit & Security In particular, the team looks if the project is audited, how extensive the audit is, at the bug bounty program, if it had incidents or not, at the liquidity on the exchanges and at the transparency of the information provided.

Tokenomics Under this criterion it is analyzed whether the project is inflationary or not, whether it has maximum supply, the percentage of supply released into the market at the time of the analysis, the rate of inflation per year, the distribution of supply in the portfolios as well as the vesting plan.

Ecosistem Development In this section is checked if the project has delivered on time what it proposed in the roadmap, the degree of participation in the project governance of the community, the activity and intensity of the developments published on github and what products or applications the team proposes to develop in the future.

Team & Developers It checks if the team is public, the quality of the team behind the project, the number of members on different domains, the experience in IT, finance and cryptography, the traceability of published information about team members and as well the number of developers in the project.

Product & Utility It checks if there are functional products, the number of users and the revenues generated by these products, the sustainability of the project and the usefulness offered in the cryptographic space and as well as in other fields of activity.

Partners & Investors It analyzes the partners and the degree of their involvement in the project, the capacity of investors and investment funds that can contribute substantially to the development of the ecosystem.

Social & Mass Media In this section was taken into consideration the intensity of the activity of the social media page of the administrators , the speed of the community growth, the user interaction with the pages and as well the number of media appearances in the most important trade publications.

Audit & Security In particular, the team looks if the project is audited, how extensive the audit is, at the bug bounty program, if it had incidents or not, at the liquidity on the exchanges and at the transparency of the information provided.

Tokenomics Under this criterion it is analyzed whether the project is inflationary or not, whether it has maximum supply, the percentage of supply released into the market at the time of the analysis, the rate of inflation per year, the distribution of supply in the portfolios as well as the vesting plan.

Ecosistem Development In this section is checked if the project has delivered on time what it proposed in the roadmap, the degree of participation in the project governance of the community, the activity and intensity of the developments published on github and what products or applications the team proposes to develop in the future.

Team & Developers It checks if the team is public, the quality of the team behind the project, the number of members on different domains, the experience in IT, finance and cryptography, the traceability of published information about team members and as well the number of developers in the project.

Product & Utility It checks if there are functional products, the number of users and the revenues generated by these products, the sustainability of the project and the usefulness offered in the cryptographic space and as well as in other fields of activity.

Partners & Investors It analyzes the partners and the degree of their involvement in the project, the capacity of investors and investment funds that can contribute substantially to the development of the ecosystem.

This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish.

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| _ga | coin-score.ai | Google Universal Analytics long-time unique user tracking identifier. | 2 years | HTTP |

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| _ga_QJD5B840TY | coin-score.ai | --- | 2 years | --- |