Projects listed: 276 |

BTC Dominance: 51.12% | Volume (24h): $42,578,317,585 | Market Cap: $2,607,341,578,875

Projects listed: 276 |

Sector

Exchange Debut

Market Cap

Maxim Supply

Circulating Supply

Circ. Supply(%)

Price

Market Cap

Sector

Exchange Debut

Volume 24h

High 24h

Low 24h

Change 24h

Change 7d

Change 30d

Maxim supply

Circulating supply

Circulating supply(%)

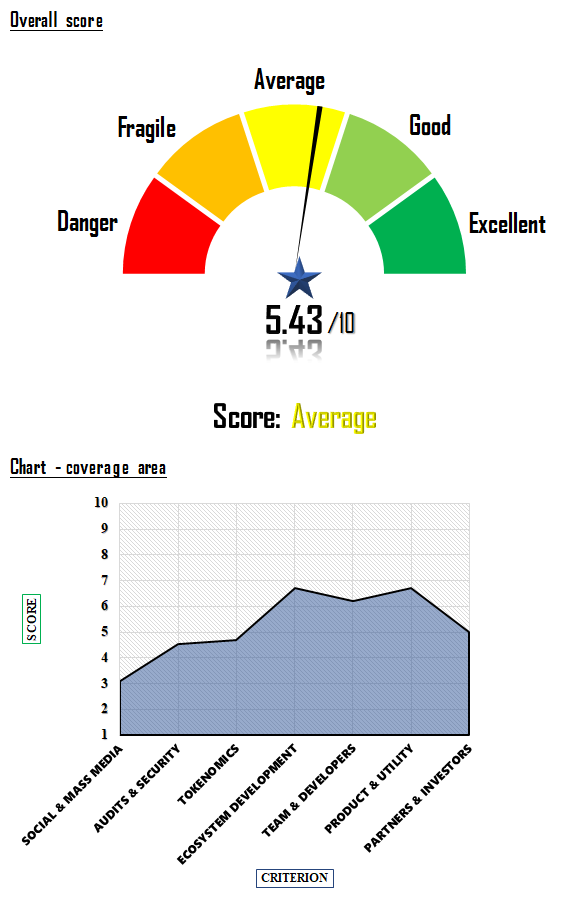

Hifi Finance, a decentralized finance protocol, facilitates lending and borrowing of crypto at a fixed interest rate through its Automated Market Maker model. Based on a fundamental analysis of the Hifi Finance cryptocurrency, the project has earned a moderate score of 5.43 out of 10. This suggests that while it has promising elements, particularly in ecosystem development and utility, it faces challenges in areas like social media engagement and audit security.

The Hifi Finance project falls significantly short in its social and media engagement. Despite average community activity, its ability to attract followers is considerably low, with a score of 1 out of 10. This indicates an urgent need to revamp its marketing strategies and social media presence to generate more public interest.

The project’s audit and security landscape is a concern. While transparency and liquidity on exchanges are decent, the audit results are subpar. Enhancing security measures and undergoing more rigorous audits could potentially elevate the fundamental analysis of the Hifi Finance cryptocurrency in future assessments.

Tokenomics is another area where Hifi Finance needs improvement. The monetary policy appears somewhat centralized and suffers from inflationary tendencies, both of which could undermine long-term stability and investor confidence.

Hifi Finance fares relatively well in ecosystem development. It has successfully achieved its objectives and has plans for future developments, which could possibly make the project more appealing over time.

The team behind Hifi Finance has adequate experience but lacks in numbers, especially in software development. Increasing the team size could offer a broader skill set and resources, thereby strengthening the project.

The product offers moderate utility in the current ecosystem. The tokens are useful, but the overall utility could be better. As the project evolves, enhancing its features could substantially elevate its standing.

In terms of partners and investors, the project is average. While it has a decent quality of partnerships, the capacity of investors is less than impressive. This could be a focus area for growth.

Based on the fundamental analysis of the Hifi Finance cryptocurrency, the project shows moderate potential but also presents several red flags, particularly in social engagement and security measures. While it offers some investment opportunity, notably in its ecosystem development and utility, potential investors must exercise caution. The overall moderate scores in multiple domains signify that risks are present. Until improvements are made, especially in security, social media engagement, and team expansion, the project may not represent an optimal investment opportunity.

Hifi Finance, initially called Mainframe, emerged as a decentralized finance (DeFi) protocol in 2017. The platform allows users to lend and borrow cryptocurrency at a fixed interest rate, which makes it stand out from similar protocols offering variable rates. This feature contributes to predictability, making it easier for borrowers to know their costs and for lenders to anticipate their earnings. In Hifi’s structure, users supply tokens to liquidity pools that function based on an Automated Market Maker model. The algorithm in this model adjusts the interest rate depending on supply and demand.

Hifi operates through a system of smart contracts and utilizes its ERC-20 token, HIFI, for governance. The community plays a significant role in shaping the protocol through proposals and votes, enabling changes like parameter adjustments or adding new collateral types. Currently, there are 126.25 million HIFI tokens, with 101.25 million (or 80%) in circulation. The remaining will be distributed over the next two years.

In terms of security, Hifi has implemented a robust system of smart contracts, featuring a bond-like instrument called hTokens. These tokens represent an obligation that settles on a specific future date. To maintain the protocol’s integrity, a collateralization factor is enforced. If collateral levels fall below a certain threshold, liquidators can purchase the debt at a discount, helping to restore balance within the system.

In summary, the fundamental analysis of the Hifi Finance-HIFI cryptocurrency reveals a unique DeFi platform offering fixed interest rates, robust governance, and strong security measures. With features like these, Hifi caters to both borrowers and lenders looking for more predictability and control in decentralized finance.

Social & Mass Media In this section was taken into consideration the intensity of the activity of the social media page of the administrators , the speed of the community growth, the user interaction with the pages and as well the number of media appearances in the most important trade publications.

Audit & Security In particular, the team looks if the project is audited, how extensive the audit is, at the bug bounty program, if it had incidents or not, at the liquidity on the exchanges and at the transparency of the information provided.

Tokenomics Under this criterion it is analyzed whether the project is inflationary or not, whether it has maximum supply, the percentage of supply released into the market at the time of the analysis, the rate of inflation per year, the distribution of supply in the portfolios as well as the vesting plan.

Ecosistem Development In this section is checked if the project has delivered on time what it proposed in the roadmap, the degree of participation in the project governance of the community, the activity and intensity of the developments published on github and what products or applications the team proposes to develop in the future.

Team & Developers It checks if the team is public, the quality of the team behind the project, the number of members on different domains, the experience in IT, finance and cryptography, the traceability of published information about team members and as well the number of developers in the project.

Product & Utility It checks if there are functional products, the number of users and the revenues generated by these products, the sustainability of the project and the usefulness offered in the cryptographic space and as well as in other fields of activity.

Partners & Investors It analyzes the partners and the degree of their involvement in the project, the capacity of investors and investment funds that can contribute substantially to the development of the ecosystem.

Social & Mass Media In this section was taken into consideration the intensity of the activity of the social media page of the administrators , the speed of the community growth, the user interaction with the pages and as well the number of media appearances in the most important trade publications.

Audit & Security In particular, the team looks if the project is audited, how extensive the audit is, at the bug bounty program, if it had incidents or not, at the liquidity on the exchanges and at the transparency of the information provided.

Tokenomics Under this criterion it is analyzed whether the project is inflationary or not, whether it has maximum supply, the percentage of supply released into the market at the time of the analysis, the rate of inflation per year, the distribution of supply in the portfolios as well as the vesting plan.

Ecosistem Development In this section is checked if the project has delivered on time what it proposed in the roadmap, the degree of participation in the project governance of the community, the activity and intensity of the developments published on github and what products or applications the team proposes to develop in the future.

Team & Developers It checks if the team is public, the quality of the team behind the project, the number of members on different domains, the experience in IT, finance and cryptography, the traceability of published information about team members and as well the number of developers in the project.

Product & Utility It checks if there are functional products, the number of users and the revenues generated by these products, the sustainability of the project and the usefulness offered in the cryptographic space and as well as in other fields of activity.

Partners & Investors It analyzes the partners and the degree of their involvement in the project, the capacity of investors and investment funds that can contribute substantially to the development of the ecosystem.

This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish.

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| _ga | coin-score.ai | Google Universal Analytics long-time unique user tracking identifier. | 2 years | HTTP |

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| _ga_QJD5B840TY | coin-score.ai | --- | 2 years | --- |