Projects listed: 276 |

BTC Dominance: 0.00% | Volume (24h): $42,813,574,301 | Market Cap: $2,608,506,877,151

Projects listed: 276 |

Sector

Exchange Debut

Market Cap

Maxim Supply

Circulating Supply

Circ. Supply(%)

Price

Market Cap

Sector

Exchange Debut

Volume 24h

High 24h

Low 24h

Change 24h

Change 7d

Change 30d

Maxim supply

Circulating supply

Circulating supply(%)

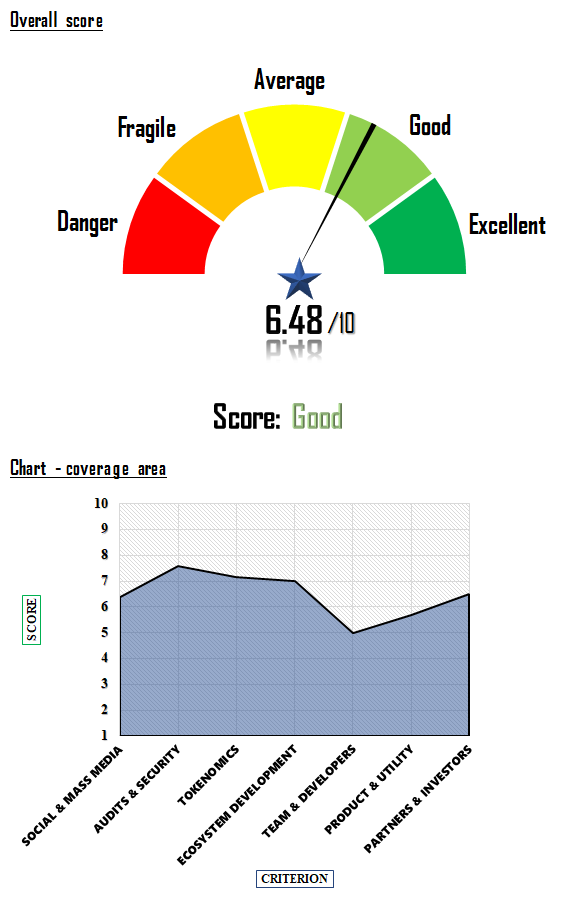

Stader – SD is a progressive crypto project focused on developing key staking middleware infrastructure for various Proof of Stake (PoS) networks. It aims to cater to a diverse audience including retail crypto users, exchanges, and custodians. The project’s versatility is evident in its development of highly modular smart contracts, enabling third-party customization and solution-building. Stader’s short-term objectives include native contract development across multiple chains such as Terra, Solana, Ethereum, Near, Avalanche, Fantom, and more. It’s also actively working on creating an economic ecosystem that supports various functionalities like yield farming, liquid staking, launchpads, and gaming. For the long-term, Stader’s vision is to open its platform for further development, encouraging the creation of various staking applications using its infrastructure. The fundamental analysis of the Stader – SD cryptocurrency reveals a balanced score of 6.48 out of 10, reflecting both its strengths and areas for improvement.

The fundamental analysis of the Stader – SD cryptocurrencyin the realm of social and mass media presents a mixed picture. While Stader excels in attracting followers on social media and maintaining active social media administrators (both scoring a perfect 10), it falls short in community activity on social media pages, scoring only 1 out of 10. Its presence in the media is strong, scoring 9 out of 10, and the size of its chat group communities is moderate with a score of 6 out of 10. This suggests that while Stader is visible and active online, it may need to bolster community engagement to better leverage its social media presence.

In terms of audit and security, Stader scores a respectable 7.6 out of 10. The project has shown good results in audits, scoring 8.5, which indicates a high level of security and reliability in its systems. However, transparency of information available to the public is a bit lacking, with a score of 5 out of 10, suggesting room for improvement in openness and communication. Liquidity on exchanges, an essential factor for stability, scores a 6 out of 10, pointing to the need for stronger liquidity management.

The fundamental analysis of the Stader – SD cryptocurrency shows solid tokenomics with a score of 7.15 out of 10. The project scores high in controlling inflation, earning 9 out of 10, which is crucial for maintaining token value. However, the centralization of the monetary mass is a concern, scoring only 5 out of 10. This suggests a need for more decentralization in token distribution to enhance trust and participation in the ecosystem.

Stader’s ecosystem development scores a 7 out of 10. The project has been moderately successful in achieving its objectives (7 out of 10) and shows promise in bringing new developments to the project, scoring 6.5 out of 10. This indicates steady progress but highlights the need for more rapid development and innovation to stay competitive.

The team and developers behind Stader score a 5 out of 10 in the fundamental analysis of the Stader – SD cryptocurrency. Both the experience of the team and the number of software developers score 5 out of 10. This suggests that while the team is competent, there is significant room for growth and expertise development to drive the project forward more effectively.

The product and utility aspect of Stader scores a 5.7 out of 10. The utility of the product is recognized with a higher score of 7.5 out of 10, indicating that the project offers valuable features and tools. However, the utility of tokens in the ecosystem is less impressive, scoring only 3 out of 10, suggesting a need for better integration and usefulness of the tokens within the Stader ecosystem.

In the partners and investors category, Stader achieves a score of 6.5 out of 10. The quality of partners is strong, scoring 8 out of 10, but the number and capacity of investors score lower at 5 out of 10. This points to a robust partnership network but indicates potential for growth in attracting and retaining investors.

The fundamental analysis of the Stader – SD cryptocurrency culminates in a nuanced view of the project. With an overall score of 6.48 out of 10, Stader shows promise in several areas, particularly in its product utility and ecosystem development. However, there are notable areas for improvement, such as enhancing community engagement, increasing transparency, decentralizing token distribution, and strengthening its team and investor base. From a risk and investment perspective, Stader presents a balanced profile with potential for growth and innovation, but also with areas that warrant careful observation and improvement. Investors and stakeholders should consider these factors in their decision-making, keeping in mind the dynamic and evolving nature of the crypto market.

Stader is a key player in the cryptocurrency ecosystem, focusing on developing staking middleware infrastructures for multiple Proof of Stake (PoS) networks. This initiative targets retail crypto users, exchanges, and custodians, aiming to enhance their engagement and experience in the crypto realm. Central to Stader’s strategy is the development of highly modular smart contracts. These contracts are designed to be adaptable, allowing third parties to leverage Stader’s components for creating customized solutions.

In the short term, Stader’s efforts are concentrated on creating native contracts across various blockchain networks, including Terra, Solana, Ethereum, Near, Avalanche, and Fantom. A significant part of this phase involves establishing an economic ecosystem. This ecosystem is expected to foster growth and development in areas such as yield redirection-style farming with rewards, liquid staking, launchpads, gaming, and more. These initiatives are crucial for Stader’s expansion and for providing diverse solutions in the cryptocurrency space.

Looking towards the future, Stader aims to unlock a platform approach, focusing on nurturing third-party development of various staking applications using Stader’s infrastructure. This long-term goal underscores Stader’s commitment to becoming a foundational component in the crypto staking landscape, promoting innovation and collaboration.

The Stader (SD) token functions as the native governance and value accrual token within the Stader ecosystem. It is intricately linked to the platform, with its value and utility being central to Stader’s operations. The SD token has several key utilities:

Stader’s primary revenue source is the fees charged on rewards, ranging between 3%-10%. These fees are integral to the platform’s sustainability, with a portion being distributed to SD token stakers. This revenue model reflects the intrinsic value of SD tokens within the Stader ecosystem.

Social & Mass Media In this section was taken into consideration the intensity of the activity of the social media page of the administrators , the speed of the community growth, the user interaction with the pages and as well the number of media appearances in the most important trade publications.

Audit & Security In particular, the team looks if the project is audited, how extensive the audit is, at the bug bounty program, if it had incidents or not, at the liquidity on the exchanges and at the transparency of the information provided.

Tokenomics Under this criterion it is analyzed whether the project is inflationary or not, whether it has maximum supply, the percentage of supply released into the market at the time of the analysis, the rate of inflation per year, the distribution of supply in the portfolios as well as the vesting plan.

Ecosistem Development In this section is checked if the project has delivered on time what it proposed in the roadmap, the degree of participation in the project governance of the community, the activity and intensity of the developments published on github and what products or applications the team proposes to develop in the future.

Team & Developers It checks if the team is public, the quality of the team behind the project, the number of members on different domains, the experience in IT, finance and cryptography, the traceability of published information about team members and as well the number of developers in the project.

Product & Utility It checks if there are functional products, the number of users and the revenues generated by these products, the sustainability of the project and the usefulness offered in the cryptographic space and as well as in other fields of activity.

Partners & Investors It analyzes the partners and the degree of their involvement in the project, the capacity of investors and investment funds that can contribute substantially to the development of the ecosystem.

Social & Mass Media In this section was taken into consideration the intensity of the activity of the social media page of the administrators , the speed of the community growth, the user interaction with the pages and as well the number of media appearances in the most important trade publications.

Audit & Security In particular, the team looks if the project is audited, how extensive the audit is, at the bug bounty program, if it had incidents or not, at the liquidity on the exchanges and at the transparency of the information provided.

Tokenomics Under this criterion it is analyzed whether the project is inflationary or not, whether it has maximum supply, the percentage of supply released into the market at the time of the analysis, the rate of inflation per year, the distribution of supply in the portfolios as well as the vesting plan.

Ecosistem Development In this section is checked if the project has delivered on time what it proposed in the roadmap, the degree of participation in the project governance of the community, the activity and intensity of the developments published on github and what products or applications the team proposes to develop in the future.

Team & Developers It checks if the team is public, the quality of the team behind the project, the number of members on different domains, the experience in IT, finance and cryptography, the traceability of published information about team members and as well the number of developers in the project.

Product & Utility It checks if there are functional products, the number of users and the revenues generated by these products, the sustainability of the project and the usefulness offered in the cryptographic space and as well as in other fields of activity.

Partners & Investors It analyzes the partners and the degree of their involvement in the project, the capacity of investors and investment funds that can contribute substantially to the development of the ecosystem.

This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish.

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| _ga | coin-score.ai | Google Universal Analytics long-time unique user tracking identifier. | 2 years | HTTP |

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| _ga_QJD5B840TY | coin-score.ai | --- | 2 years | --- |