Projects listed: 276 |

BTC Dominance: 0.00% | Volume (24h): $42,760,683,042 | Market Cap: $2,606,171,496,414

Projects listed: 276 |

Sector

Exchange Debut

Market Cap

Maxim Supply

Circulating Supply

Circ. Supply(%)

Price

Market Cap

Sector

Exchange Debut

Volume 24h

High 24h

Low 24h

Change 24h

Change 7d

Change 30d

Maxim supply

Circulating supply

Circulating supply(%)

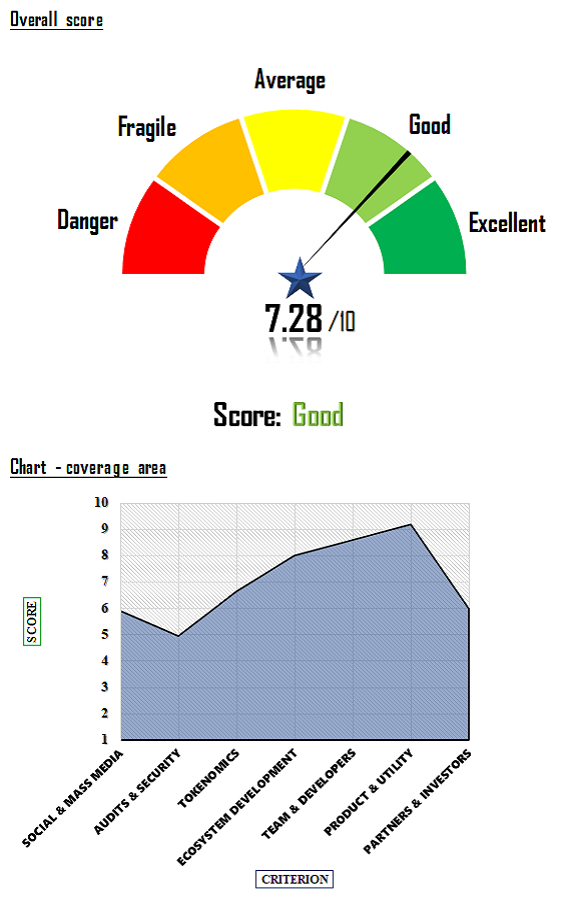

In comprehensive fundamental analysis of the Singularity NET cryptocurrency, we’ve found it to be a pioneering project in the realm of decentralized artificial intelligence platforms, utilizing blockchain technology. The primary focus of Singularity NET is fostering the development of Artificial General Intelligence (AGI), aiming towards a beneficial technological Singularity. With a multi-faceted evaluation, the project has been assigned a commendable final score of 7.28 out of 10, indicating potential in several areas.

When it comes to Audit and Security, a critical factor in the fundamental analysis of the Singularity NET cryptocurrency, the project garnered a score of 4.95 out of 10. Despite impressive transparency and satisfactory liquidity on various exchanges, the project fell short in the audit test, resulting in a less than ideal score. This could potentially raise concerns for investors, affecting their confidence in the project.

The Social and Media aspect of the project, another vital parameter in fundamental analysis of the Singularity NET cryptocurrency, has achieved a score of 5.9 out of 10. The project shines in terms of media presence, receiving a perfect sub-score in that area. However, the lack of a robust and engaged community on social platforms and chat groups is a noticeable drawback. This could impede the project’s growth and slow down the acceptance of its proposed solutions.

In evaluating the Team criterion, the project scored an impressive 8.6 out of 10. The team is highly competent, bringing in-depth knowledge and experience in artificial intelligence solution development. A point of concern, however, is the low score in the sub-criterion related to the number of software developers, which could potentially cause delays in the project’s progression.

The Product and Utility criterion of Singularity NET scored a robust 9.2 out of 10. The product’s utility is exceptional, anchored on an artificial intelligence platform that can cater to various domains. Coupled with the high utility of tokens within its ecosystem, it’s plausible to predict a surge in demand for these tokens.

In summary, fundamental analysis of the Singularity NET cryptocurrency reveals it as a project with a decent overall score. However, it must tackle certain areas of concern, specifically in Audit and Security, and Social and Media aspects, which could potentially hinder project growth and investor trust. Nevertheless, with high scores in Team and Product and Utility criteria, Singularity NET could still present an attractive proposition for investors.

Creating an equitable distribution of power, value and technology across global communities.

AI systems focused on making the world a more compassionate, just and sustainable place, now and in the future.

SingularityNET was founded by Dr. Ben Goertzel with a mission to create a decentralized, democratic, inclusive and beneficial Artificial General Intelligence. An „AGI” that is not dependent on any central entity, that is open to anyone, and that is not limited to the narrow goals of a single corporation or even a single country.

The SingularityNET team includes:experienced engineers, scientists, researchers, entrepreneurs and marketers. Their core platform and artificial intelligence teams are further complemented by specialist teams dedicated to application areas such as finance, robotics, biomedical AI, media, arts and entertainment.

At SingularityNET, work is underway on a series of interconnected projects that all share the same goal of achieving a beneficial technological singularity. They are actively building on their core technologies OpenCog Hyperon, AI-DSL and the SingularityNET AI platform, supported by NuNet distributed computing, Hypercycle-optimized blockchain interactions and a strong partnership with Cardano. At the same time, it promotes the use of the SingularityNET platform by seeding it with AI services from a number of spin-off projects in strategically selected vertical markets.

Social & Mass Media In this section was taken into consideration the intensity of the activity of the social media page of the administrators , the speed of the community growth, the user interaction with the pages and as well the number of media appearances in the most important trade publications.

Audit & Security In particular, the team looks if the project is audited, how extensive the audit is, at the bug bounty program, if it had incidents or not, at the liquidity on the exchanges and at the transparency of the information provided.

Tokenomics Under this criterion it is analyzed whether the project is inflationary or not, whether it has maximum supply, the percentage of supply released into the market at the time of the analysis, the rate of inflation per year, the distribution of supply in the portfolios as well as the vesting plan.

Ecosistem Development In this section is checked if the project has delivered on time what it proposed in the roadmap, the degree of participation in the project governance of the community, the activity and intensity of the developments published on github and what products or applications the team proposes to develop in the future.

Team & Developers It checks if the team is public, the quality of the team behind the project, the number of members on different domains, the experience in IT, finance and cryptography, the traceability of published information about team members and as well the number of developers in the project.

Product & Utility It checks if there are functional products, the number of users and the revenues generated by these products, the sustainability of the project and the usefulness offered in the cryptographic space and as well as in other fields of activity.

Partners & Investors It analyzes the partners and the degree of their involvement in the project, the capacity of investors and investment funds that can contribute substantially to the development of the ecosystem.

Social & Mass Media In this section was taken into consideration the intensity of the activity of the social media page of the administrators , the speed of the community growth, the user interaction with the pages and as well the number of media appearances in the most important trade publications.

Audit & Security In particular, the team looks if the project is audited, how extensive the audit is, at the bug bounty program, if it had incidents or not, at the liquidity on the exchanges and at the transparency of the information provided.

Tokenomics Under this criterion it is analyzed whether the project is inflationary or not, whether it has maximum supply, the percentage of supply released into the market at the time of the analysis, the rate of inflation per year, the distribution of supply in the portfolios as well as the vesting plan.

Ecosistem Development In this section is checked if the project has delivered on time what it proposed in the roadmap, the degree of participation in the project governance of the community, the activity and intensity of the developments published on github and what products or applications the team proposes to develop in the future.

Team & Developers It checks if the team is public, the quality of the team behind the project, the number of members on different domains, the experience in IT, finance and cryptography, the traceability of published information about team members and as well the number of developers in the project.

Product & Utility It checks if there are functional products, the number of users and the revenues generated by these products, the sustainability of the project and the usefulness offered in the cryptographic space and as well as in other fields of activity.

Partners & Investors It analyzes the partners and the degree of their involvement in the project, the capacity of investors and investment funds that can contribute substantially to the development of the ecosystem.

This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish.

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| _ga | coin-score.ai | Google Universal Analytics long-time unique user tracking identifier. | 2 years | HTTP |

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| _ga_QJD5B840TY | coin-score.ai | --- | 2 years | --- |