Projects listed: 276 |

BTC Dominance: 49.11% | Volume (24h): $32,770,673,789 | Market Cap: $2,449,351,917,700

Projects listed: 276 |

Sector

Exchange Debut

Market Cap

Maxim Supply

Circulating Supply

Circ. Supply(%)

Price

Market Cap

Sector

Exchange Debut

Volume 24h

High 24h

Low 24h

Change 24h

Change 7d

Change 30d

Maxim supply

Circulating supply

Circulating supply(%)

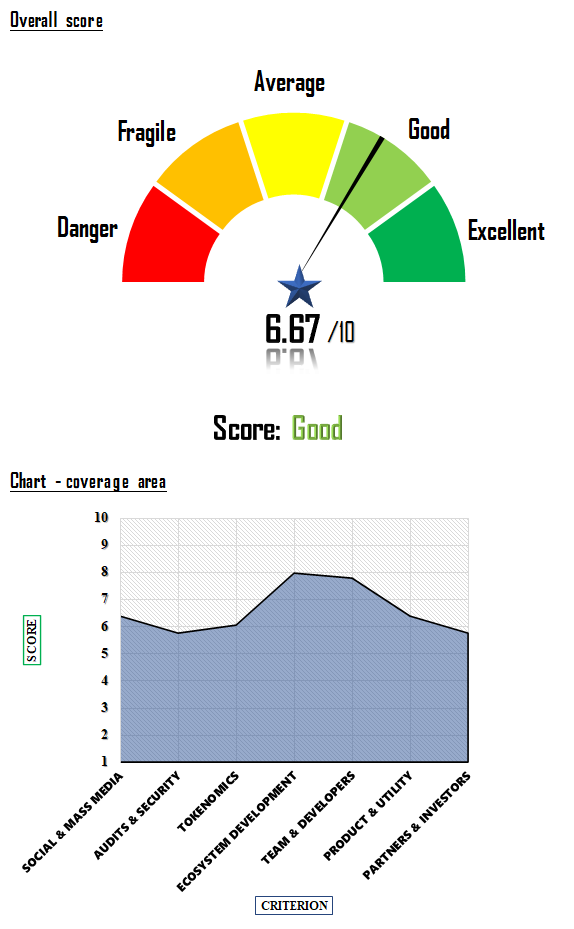

Radix, a layer 1 smart contract platform, is setting its sights on revolutionizing the $400 trillion global financial system. After almost a decade of comprehensive research, development, and testing, it introduces an array of compelling features including Scrypto, its unique asset-oriented programming language, the world-first programmable DeFi Engine known as Radix Engine, and the Cerberus consensus algorithm promising atomic composability with linear scalability. The fundamental analysis of the Radix cryptocurrency, which is the subject of our review today, yields a general score of 6.67 out of 10.

Social media presence is integral to the success of a crypto project in today’s digital world. Radix has demonstrated decent potential in this domain, with an overall score of 6.4 out of 10. Its ability to attract followers and the activities of social media administrators could be improved, with scores of 5 out of 10. Nevertheless, the community activity on social platforms and the size of chat groups are commendable with a score of 8 out of 10. Media presence is satisfactory but could benefit from further enhancement.

The safety and transparency of a crypto project are of paramount importance for investors. While Radix does display promising aspects with a transparent score of 7 out of 10, and liquidity on Exchange reaching 8 out of 10, the results of the audits could be better, resulting in an overall score of 5.75 out of 10. The fundamental analysis of the Radix cryptocurrency thus suggests room for improvement in this regard.

The tokenomics of Radix leans more toward the positive side with an overall score of 6.08 out of 10. The project is slightly inflationary, and its monetary mass displays a moderate level of centralization, both scoring above the average mark.

ECOSYSTEM DEVELOPMENT: Score 7.96 out of 10

Radix’s ecosystem development holds promise. The achievement of its objectives and future development plans both stand at 7.4 out of 10. This shows that Radix has been successful in reaching its goals and is keen on continuous improvement and expansion.

One of the critical strengths of Radix is its team, scoring 7.8 out of 10. The team’s experience stands out with a score of 8.5 out of 10, although the number of software developers could be increased to drive further growth and innovation.

Radix’s product utility, as well as the utility of tokens in the ecosystem, have been quite promising, with scores of 6 and 7 out of 10, respectively. The overall product and utility score is 6.4 out of 10.

Partnerships and investors play a critical role in a project’s success. With a score of 5.75 out of 10, Radix shows potential in this area. The number and capacity of investors are good, but the number and quality of partners could be enhanced.

In conclusion, the fundamental analysis of the Immutable cryptocurrency suggests promising potential for the project, underpinned by its advanced technology, scalability, and the experienced team behind it. However, investors should bear in mind the inherent risks, including the inflationary nature of the token and a lower degree of decentralization. The team’s capabilities and the utility of the IMX token within the platform provide optimism for future growth and development. Hence, despite some areas of concern, the fundamental analysis of the Immutable cryptocurrency positions it as a potential player in the evolving cryptocurrency landscape.

A Revolutionary Vision: Radix Cryptocurrency (XRD)

Diving into a fundamental analysis of Radix Cryptocurrency (XRD), Radix emerges as a pioneering Layer 1 smart contract platform. Its primary mission is to disrupt the massive $400 trillion global financial industry, a goal from which its design originated.

Origins and Evolution of Radix

The brainchild of UK-based visionary Dan Hughes, Radix was initially launched as eMunie. Hughes identified scalability as the main challenge and thus developed several consensus frameworks including Blocktrees, Directed Acyclic Graphs, and finally, Cerberus.

Leadership Shift and Growth

In 2017, the leadership baton passed to CEO Piers Ridyard, marking a new era for Radix. Funding from key industry figures and organizations, including Taavet Hinrikus, co-founder of TransferWise, and leading European VC, LocalGlobe, propelled Radix’s growth.

Innovations and Future Prospects

The launch of Cerberus in 2020, the world’s first cross-shard, atomically composable consensus protocol, signaled a breakthrough. Three unique offerings position Radix at the forefront: Scrypto, an asset-centric programming language; Radix Engine, the first “DeFi Engine”; and Cerberus, a unique consensus algorithm. The anticipated “Babylon” update, due in 2023, is set to integrate production smart contracts written in Scrypto onto the mainnet.

Radix: Shaping the Future of DeFi

Through the integration of Scrypto, Radix Engine, and Cerberus, Radix seeks to deliver an unparalleled DeFi platform, primed to shape the future of global financial transactions.

Social & Mass Media In this section was taken into consideration the intensity of the activity of the social media page of the administrators , the speed of the community growth, the user interaction with the pages and as well the number of media appearances in the most important trade publications.

Audit & Security In particular, the team looks if the project is audited, how extensive the audit is, at the bug bounty program, if it had incidents or not, at the liquidity on the exchanges and at the transparency of the information provided.

Tokenomics Under this criterion it is analyzed whether the project is inflationary or not, whether it has maximum supply, the percentage of supply released into the market at the time of the analysis, the rate of inflation per year, the distribution of supply in the portfolios as well as the vesting plan.

Ecosistem Development In this section is checked if the project has delivered on time what it proposed in the roadmap, the degree of participation in the project governance of the community, the activity and intensity of the developments published on github and what products or applications the team proposes to develop in the future.

Team & Developers It checks if the team is public, the quality of the team behind the project, the number of members on different domains, the experience in IT, finance and cryptography, the traceability of published information about team members and as well the number of developers in the project.

Product & Utility It checks if there are functional products, the number of users and the revenues generated by these products, the sustainability of the project and the usefulness offered in the cryptographic space and as well as in other fields of activity.

Partners & Investors It analyzes the partners and the degree of their involvement in the project, the capacity of investors and investment funds that can contribute substantially to the development of the ecosystem.

Social & Mass Media In this section was taken into consideration the intensity of the activity of the social media page of the administrators , the speed of the community growth, the user interaction with the pages and as well the number of media appearances in the most important trade publications.

Audit & Security In particular, the team looks if the project is audited, how extensive the audit is, at the bug bounty program, if it had incidents or not, at the liquidity on the exchanges and at the transparency of the information provided.

Tokenomics Under this criterion it is analyzed whether the project is inflationary or not, whether it has maximum supply, the percentage of supply released into the market at the time of the analysis, the rate of inflation per year, the distribution of supply in the portfolios as well as the vesting plan.

Ecosistem Development In this section is checked if the project has delivered on time what it proposed in the roadmap, the degree of participation in the project governance of the community, the activity and intensity of the developments published on github and what products or applications the team proposes to develop in the future.

Team & Developers It checks if the team is public, the quality of the team behind the project, the number of members on different domains, the experience in IT, finance and cryptography, the traceability of published information about team members and as well the number of developers in the project.

Product & Utility It checks if there are functional products, the number of users and the revenues generated by these products, the sustainability of the project and the usefulness offered in the cryptographic space and as well as in other fields of activity.

Partners & Investors It analyzes the partners and the degree of their involvement in the project, the capacity of investors and investment funds that can contribute substantially to the development of the ecosystem.

This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish.

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| _ga | coin-score.ai | Google Universal Analytics long-time unique user tracking identifier. | 2 years | HTTP |

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| _ga_QJD5B840TY | coin-score.ai | --- | 2 years | --- |