Projects listed: 276 |

BTC Dominance: 0.00% | Volume (24h): $38,309,937,378 | Market Cap: $2,479,543,930,792

Projects listed: 276 |

Sector

Exchange Debut

Market Cap

Maxim Supply

Circulating Supply

Circ. Supply(%)

Price

Market Cap

Sector

Exchange Debut

Volume 24h

High 24h

Low 24h

Change 24h

Change 7d

Change 30d

Maxim supply

Circulating supply

Circulating supply(%)

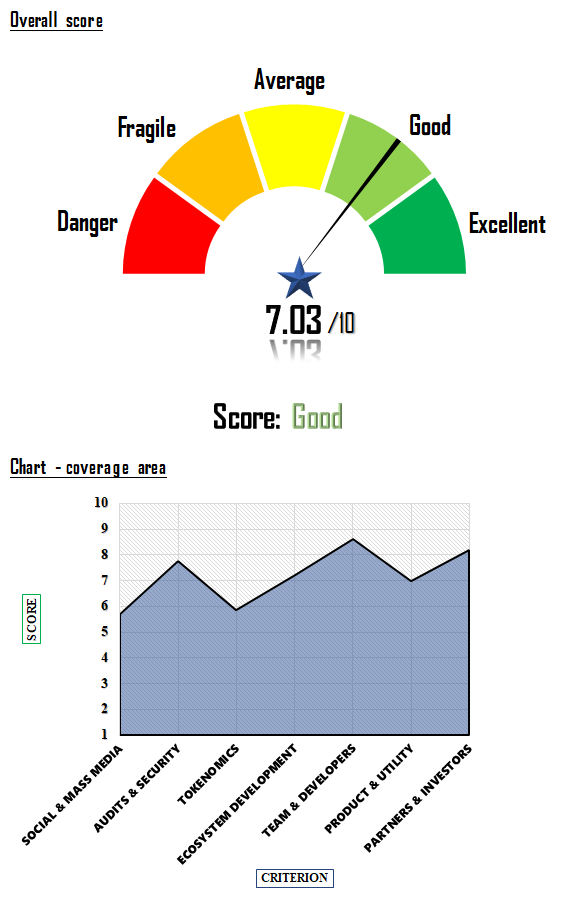

Aleph Zero (AZERO) is a forward-thinking cryptocurrency project, emphasizing privacy, rapid finality, and an enterprise-level performance. Based on a unique Directed Acyclic Graph (DAG) consensus, this blockchain-based platform stands out as an essential player in the crypto space. Successfully raising $15m for its development and being a part of the Substrate Builders Program, Aleph Zero’s prospects appear promising, reflected in its commendable score of 7.03 out of 10 in our fundamental analysis of the Aleph Zero – AZERO cryptocurrency.

The project has shown a significant capability in attracting followers on social platforms with an impressive score of 8 out of 10. However, a less active social media administration and moderate community engagement dampen its score slightly. Their media presence is relatively low, which could be an area of improvement for the project. The chat groups have sizeable communities, showcasing interest and discussions among enthusiasts.

Our fundamental analysis of the Aleph Zero – AZERO cryptocurrency reveals commendable transparency and promising audit results, with scores of 9.5 and 8, respectively. However, liquidity on exchanges is moderate, indicating the need for broader market penetration and accessibility.

Aleph Zero showcases a centralized monetary mass, earning it a high score of 9. However, being inflationary brings its score down slightly, reflecting potential concerns over the coin’s long-term value retention.

The platform’s achievement of its objectives is moderate, suggesting that while they’ve come a long way since inception, there’s room for growth. Future developments are anticipated but are similarly rated at a mid-range score.

The team behind Aleph Zero is highly experienced, boasting a score of 9.5, yet a moderate number of software developers might hint at the need for further team expansion to meet the project’s ambitious goals.

The utility of the product and the AZERO tokens within the ecosystem show promise. With the tokens having a higher utility score, they are integral to the platform’s operations.

Aleph Zero has attracted a notable number of capable investors and quality partners, reinforcing the project’s credibility and long-term viability.

Our detailed fundamental analysis of the Aleph Zero – AZERO cryptocurrency suggests that Aleph Zero is a robust project with a great deal of potential. With an overall score of 7.03 out of 10, it exhibits strengths in team expertise, security, and partnerships. However, areas such as media presence, token inflation, and ecosystem developments need enhancement for greater investor confidence. From an investment perspective, while Aleph Zero has a promising trajectory, potential investors should exercise caution, keeping the identified risks in mind.

Aleph Zero (AZERO) stands out as a state-of-the-art, privacy-focused Proof-of-Stake blockchain network, achieving immediate transaction finality. Originally conceptualized in 2018 and with its mainnet launching in 2021, it’s uniquely structured around a Directed Acyclic Graph (DAG)-based consensus mechanism, despite retaining the blockchain categorization. This advanced system has secured Aleph Zero a commendable $15m in funding for future expansions.

While being an integral participant of the Substrate Builders Program, Aleph Zero prides itself on its independence, distancing itself from being just another Polkadot parachain. 2023 is set to witness the unveiling of advanced privacy tools rooted in secure multi-party computation (sMPC) and zero-knowledge proofs (ZKP) research.

Steered by industry heavyweights like Adam Gągol and Matthew Niemerg, the core team comprises over 40 experts. Their collective accolades encompass prestigious honors like the ACM ICPC World Finals and the Simons-Berkeley Research Fellowship.

Major players like Bitcoin and Ethereum grapple with limited transaction speeds, impeding large-scale acceptance. Contrarily, Aleph Zero offers a breakthrough with its scalability capabilities, ensuring instantaneous finality and the potential for an expansive user base.

While traditional blockchains have faced security breaches, Aleph Zero introduces the innovative AlephBFT consensus protocol. This ensures resistance against 33% malicious entities within the network. Moreover, its asynchronous nature promises consistent transaction confirmation, even amidst network inconsistencies.

In essence, Aleph Zero’s AZERO cryptocurrency is pioneering solutions to existing blockchain challenges, making it a beacon for future digital asset endeavors.

Social & Mass Media In this section was taken into consideration the intensity of the activity of the social media page of the administrators , the speed of the community growth, the user interaction with the pages and as well the number of media appearances in the most important trade publications.

Audit & Security In particular, the team looks if the project is audited, how extensive the audit is, at the bug bounty program, if it had incidents or not, at the liquidity on the exchanges and at the transparency of the information provided.

Tokenomics Under this criterion it is analyzed whether the project is inflationary or not, whether it has maximum supply, the percentage of supply released into the market at the time of the analysis, the rate of inflation per year, the distribution of supply in the portfolios as well as the vesting plan.

Ecosistem Development In this section is checked if the project has delivered on time what it proposed in the roadmap, the degree of participation in the project governance of the community, the activity and intensity of the developments published on github and what products or applications the team proposes to develop in the future.

Team & Developers It checks if the team is public, the quality of the team behind the project, the number of members on different domains, the experience in IT, finance and cryptography, the traceability of published information about team members and as well the number of developers in the project.

Product & Utility It checks if there are functional products, the number of users and the revenues generated by these products, the sustainability of the project and the usefulness offered in the cryptographic space and as well as in other fields of activity.

Partners & Investors It analyzes the partners and the degree of their involvement in the project, the capacity of investors and investment funds that can contribute substantially to the development of the ecosystem.

Social & Mass Media In this section was taken into consideration the intensity of the activity of the social media page of the administrators , the speed of the community growth, the user interaction with the pages and as well the number of media appearances in the most important trade publications.

Audit & Security In particular, the team looks if the project is audited, how extensive the audit is, at the bug bounty program, if it had incidents or not, at the liquidity on the exchanges and at the transparency of the information provided.

Tokenomics Under this criterion it is analyzed whether the project is inflationary or not, whether it has maximum supply, the percentage of supply released into the market at the time of the analysis, the rate of inflation per year, the distribution of supply in the portfolios as well as the vesting plan.

Ecosistem Development In this section is checked if the project has delivered on time what it proposed in the roadmap, the degree of participation in the project governance of the community, the activity and intensity of the developments published on github and what products or applications the team proposes to develop in the future.

Team & Developers It checks if the team is public, the quality of the team behind the project, the number of members on different domains, the experience in IT, finance and cryptography, the traceability of published information about team members and as well the number of developers in the project.

Product & Utility It checks if there are functional products, the number of users and the revenues generated by these products, the sustainability of the project and the usefulness offered in the cryptographic space and as well as in other fields of activity.

Partners & Investors It analyzes the partners and the degree of their involvement in the project, the capacity of investors and investment funds that can contribute substantially to the development of the ecosystem.

This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish.

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| _ga | coin-score.ai | Google Universal Analytics long-time unique user tracking identifier. | 2 years | HTTP |

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| _ga_QJD5B840TY | coin-score.ai | --- | 2 years | --- |