Projects listed: 276 |

BTC Dominance: 49.10% | Volume (24h): $32,638,163,225 | Market Cap: $2,452,616,265,296

Projects listed: 276 |

Sector

Exchange Debut

Market Cap

Maxim Supply

Circulating Supply

Circ. Supply(%)

Price

Market Cap

Sector

Exchange Debut

Volume 24h

High 24h

Low 24h

Change 24h

Change 7d

Change 30d

Maxim supply

Circulating supply

Circulating supply(%)

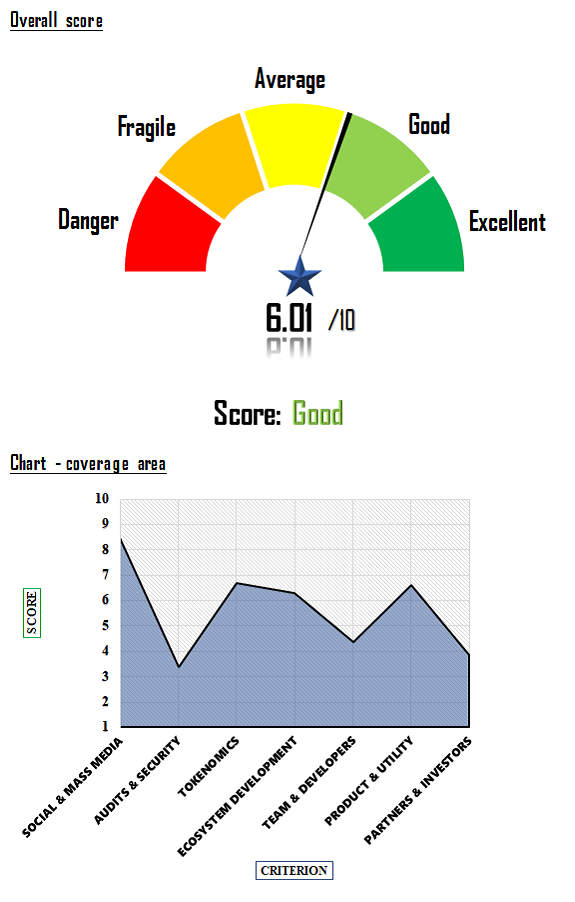

Dogecoin, a crypto project characterized by its Shiba Inu logo and born from an internet meme, boasts a fascinating mix of light-hearted appeal and significant potential for growth. In the fundamental analysis of the Dogecoin cryptocurrency, it achieves a final score of 6.01 out of 10, demonstrating its balance of strengths and areas for improvement.

Dogecoin excels in the sphere of social and mass media, largely due to its enormous popularity on social platforms and significant media presence. The community activity on its social media pages and the involvement of administrators could, however, be enhanced. If this is improved, Dogecoin can capitalize more on its strong “meme” identity.

The fundamental analysis reveals some weaknesses in the area of audit and security. The results of audits were less than ideal, indicating areas of vulnerability that need to be addressed. On the other hand, transparency and liquidity are strong points, suggesting that with improvements to its auditing processes, Dogecoin could strengthen its position in the market.

When we delve into the tokenomics, the fundamental analysis of the Dogecoin cryptocurrency shows a bit of a mixed bag. The project is somewhat inflationary which could lead to a decrease in value over time. Yet, the centralization of the monetary mass remains relatively balanced.

In terms of ecosystem development, Dogecoin displays moderate success. Its achievement of objectives and plans for new developments both show promise, yet there’s still room for improvement to truly harness its potential.

The team and developers behind Dogecoin have demonstrated a solid capacity for software development. However, there are concerns around the overall experience of the team that require attention to further stabilize the project’s growth.

In examining the product and utility in the fundamental analysis of the Dogecoin cryptocurrency, there is a reasonable degree of utility in both the product and the tokens. Maintaining and further enhancing this utility will be essential for Dogecoin’s future.

In terms of partners and investors, Dogecoin has some room for improvement. Increasing the number and capacity of investors, along with fostering more high-quality partnerships, will be crucial for the project’s growth and stability.

The fundamental analysis of the Dogecoin cryptocurrency presents a nuanced picture. Its strong social media presence and reasonable utility show promise. However, areas such as audit and security, and the involvement of partners and investors need to be improved upon.

In terms of investment, the project’s moderate final score suggests caution. Potential investors should be aware of the inflationary nature of Dogecoin, and the current concerns around audit results. However, with improvement in these areas, alongside a focus on growing its partnerships, the project could offer future potential.

In conclusion, the fundamental analysis of the Dogecoin cryptocurrency reveals a project with considerable strengths yet with areas requiring improvement. With strategic actions to enhance its weaknesses, Dogecoin could capitalize on its unique appeal and build upon its current successes.

Dogecoin, an open-source digital currency that was forked from Litecoin in 2013, was inspired by the popular “doge” internet meme featuring a Shiba Inu dog. The creation of Billy Markus from Portland, Oregon, and Jackson Palmer from Sydney, Australia, Dogecoin was intended to be a light-hearted alternative to the traditional Bitcoin audience. It has been predominantly used as a tipping system on social media platforms such as Reddit and Twitter, rewarding content creation and sharing.

The trajectory of Dogecoin was significantly influenced by Tesla CEO Elon Musk’s fervor for it. The digital currency underwent a significant rally after Musk began tweeting about it in early 2021. Despite a sharp decrease in value following Musk’s appearance on Saturday Night Live, his occasional tweets still have a profound impact on Dogecoin’s market performance.

A rising number of mainstream companies have integrated Dogecoin into their payment systems, thanks to its low transaction costs and Elon Musk’s ongoing endorsement. The list of these companies includes Tesla, AMC Theaters, GameStop, airBaltic, Dallas Mavericks, EasyDNS, Newegg, and Twitch.

In summary, a fundamental analysis of the Dogecoin cryptocurrency reveals its origin as a fun, social media tipping-oriented digital currency that has seen both booms and dips, partly due to the influence of high-profile supporters like Elon Musk. Today, its acceptance as a payment method by an increasing number of companies demonstrates its growing legitimacy in the financial world.

Social & Mass Media In this section was taken into consideration the intensity of the activity of the social media page of the administrators , the speed of the community growth, the user interaction with the pages and as well the number of media appearances in the most important trade publications.

Audit & Security In particular, the team looks if the project is audited, how extensive the audit is, at the bug bounty program, if it had incidents or not, at the liquidity on the exchanges and at the transparency of the information provided.

Tokenomics Under this criterion it is analyzed whether the project is inflationary or not, whether it has maximum supply, the percentage of supply released into the market at the time of the analysis, the rate of inflation per year, the distribution of supply in the portfolios as well as the vesting plan.

Ecosistem Development In this section is checked if the project has delivered on time what it proposed in the roadmap, the degree of participation in the project governance of the community, the activity and intensity of the developments published on github and what products or applications the team proposes to develop in the future.

Team & Developers It checks if the team is public, the quality of the team behind the project, the number of members on different domains, the experience in IT, finance and cryptography, the traceability of published information about team members and as well the number of developers in the project.

Product & Utility It checks if there are functional products, the number of users and the revenues generated by these products, the sustainability of the project and the usefulness offered in the cryptographic space and as well as in other fields of activity.

Partners & Investors It analyzes the partners and the degree of their involvement in the project, the capacity of investors and investment funds that can contribute substantially to the development of the ecosystem.

Social & Mass Media In this section was taken into consideration the intensity of the activity of the social media page of the administrators , the speed of the community growth, the user interaction with the pages and as well the number of media appearances in the most important trade publications.

Audit & Security In particular, the team looks if the project is audited, how extensive the audit is, at the bug bounty program, if it had incidents or not, at the liquidity on the exchanges and at the transparency of the information provided.

Tokenomics Under this criterion it is analyzed whether the project is inflationary or not, whether it has maximum supply, the percentage of supply released into the market at the time of the analysis, the rate of inflation per year, the distribution of supply in the portfolios as well as the vesting plan.

Ecosistem Development In this section is checked if the project has delivered on time what it proposed in the roadmap, the degree of participation in the project governance of the community, the activity and intensity of the developments published on github and what products or applications the team proposes to develop in the future.

Team & Developers It checks if the team is public, the quality of the team behind the project, the number of members on different domains, the experience in IT, finance and cryptography, the traceability of published information about team members and as well the number of developers in the project.

Product & Utility It checks if there are functional products, the number of users and the revenues generated by these products, the sustainability of the project and the usefulness offered in the cryptographic space and as well as in other fields of activity.

Partners & Investors It analyzes the partners and the degree of their involvement in the project, the capacity of investors and investment funds that can contribute substantially to the development of the ecosystem.

This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish.

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| _ga | coin-score.ai | Google Universal Analytics long-time unique user tracking identifier. | 2 years | HTTP |

| Name | Domain | Purpose | Expiry | Type |

|---|---|---|---|---|

| _ga_QJD5B840TY | coin-score.ai | --- | 2 years | --- |